MSN Program

Types of Aid

Students who demonstrate financial need according to established federal guidelines may be awarded various types of financial assistance such as fellowships, scholarships and loans.

Types of Financial Aid for Graduate Students

Scholarships

The School offers a number of scholarships to students in the MSN program. The scholarship application will be shared with newly admitted and continuing students annually in the Spring.

Audrienne H. Moseley Scholarship: This scholarship is based on financial need as determined by the FAFSA or California DREAM Act Application.

HRSA's Scholarship for Disadvantaged Students Program: This scholarship through the Health Resources & Services Administration is awarded to disadvantaged students and will cover at least 50% of tuition fees.

Regents Registration Fee Grant: These funds through the Division of Graduate Education are based on merit and require full time enrollment.

Donor Scholarships: Thanks to our generous donors, each program (MECN and APRN) has scholarships allocated based on specific criteria.

Fellowships

The UCLA Graduate Division offers several types of need/merit based support. These fellowships are described in the financial support section on the UCLA Graduate Education website. Some of these funds are allocated to the School of Nursing to use in the recruitment and retention of outstanding applicants. Please see the listing below.

Graduate Opportunity Fellowship: This program provides fellowships for entering students who are socioeconomically disadvantaged. This fellowship provides for a $20,000 stipend plus tuition (and, if necessary, nonresident supplemental tuition) for the first year of study only. Applicants compete campus wide.

Nonresident Tuition Fellowship: This fellowship pays the out of state tuition for non-resident students for their first year. One fellowship is generally allocated to the School of Nursing.

University Fellowship: This is a merit based fellowship. The fellowship of $2,000 or more goes toward tuition. Limited funds are allocated to the School of Nursing.

Direct Unsubsidized Loan

Direct Unsubsidized Loans are federally guaranteed loans that all students, regardless or need, are eligible to receive. Up to $20,500 can be awarded annually. Interest begins accruing after the first initial disbursement. Students are not required to start making payments on this loan until six (6) months after they graduate or drop below half time.

For more information please see our Loan Guides on the Publications page.

Direct Graduate PLUS Loan

The Direct PLUS Loan is a loan option for Graduate/Professional students to help pay for their educational costs. Students can borrow up to the cost of attendance minus any other financial aid that the student is receiving. Interest begins accruing upon first disbursements. Students are not required to start making payments on this loan until sixty (60) days after the loan is fully disbursed. Students may also defer payment if the student is enrolled at least half-time, or during the six (6) month period after graduation, or after the student drops below half-time enrollment.

For more information please see our Graduate Loan Guide on our forms and publications page, or our PLUS vs Private Loan fact sheet, for a quick comparison of the two types of loan.

DREAM Loan

Available to undocumented grad students who meet DREAM Act Application requirements. Students can borrow up to $4,000 annually. Interest rates will be fixed at the same rates as Federal loans with no loan fees.

Nursing Student Loan

The Nursing Student Loan (NSL) is available to nursing students who have filed a FAFSA, show exceptional financial need, are enrolled at least half time, and meet satisfactory academic progress standards.

UCLA SON's Financial Aid Office determines loan amounts, and the University Student Loan Services & Collections Office handles the promissory note, entrance and exit counseling, and repayment process for NSLs.

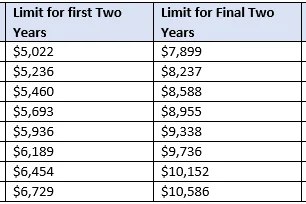

The amount you can borrow each year is based on your academic standing and award year. Please see the chart below to determine the maximum amount of NSL you may qualify for:

NSLs have a fixed interest rate of 5 percent. Interest does not accrue while you are enrolled at least half time and during deferment and grace periods.

After you stop attending school at least half time, your nine-month grace period will begin. If you enroll as a nursing student during the grace period and are approved for an in-school deferment, you will get another nine-month grace period the next time you stop attending school at least half time. If you re-enroll again, you are not eligible for another grace period.

Repayment begins when your grace period ends. The maximum repayment period is 10 years, and you will be expected to make regular payments. You may repay your loan at any time without penalty. This may reduce your interest costs significantly.

Teaching & Research Assistantships

Students serving in GSR or TA positions receive stipends and may be eligible for fee remissions. To qualify for fee remissions (in-state resident tuition), a TA/GSR position needs to be a 25% working appointment (10 hours per week). GSR appointments of at least 45% time (18 hours a week) may also be eligible to receive nonresident tuition. For positions of less than 10 hours a week, tuition is not covered. Note that GSR/TA positions do not cover professional fees, regardless of the appointment percentage.

The following fee categories are covered by fee remissions benefits:

- Health Insurance - 100%

- Tuition - 100%

- Student Services Fee - 100%

- Campus Fee - 100% (ASE only)

- Nonresident Supplemental Tuition - 100% (GSR only)

Learn more about working at UCLA.

Employee Reduced Fee Program

Qualifying career employees at UC may be eligible to receive a two-thirds (66%) reduction in the Tuition and Student Services fees (note: this benefit does not apply to the Professional Degree Supplemental Tuition). Enrollment for nursing students is limited to twelve (12) units or four (4) courses, whichever is greater.

Applications must be submitted quarterly once term fees are assessed. UCLA employees may access the Employee Experience Center to submit the Employee Reduced Fee Enrollment Application. Employees at other UCs must complete a paper application.

Private Loan

Choosing how to finance your education is one of the most important decisions you will make - and the impact of that decision will follow you well beyond graduation. Once you have exhausted your eligibility for Federal, State, and University financial aid and loans, you may need to consider applying for a private educational loan, also called an alternative loan. These loans are not federal student loans. They are offered by private lenders and are used to supplement other types of financial aid. The interest rates and repayment terms on these loans may vary.

Students may refer to the UC Preferred Lender List which includes lenders that have been extensively evaluated by the University of California Office of the President and found to provide competitive rates and loan terms to students.

Native American Opportunity Plan

Starting in fall 2022, the University of California Native American Opportunity Plan ensures that in-state systemwide mandatory tuition and fees are fully covered for California residents who are members of federally recognized Native American, American Indian and Alaska Native tribes.

Eligibility

Students do not need to fill out an application to qualify. To be eligible for NAOP funding, students must meet all of the following criteria:

1. Must be a current or newly admitted University of California graduate or professional school student.

2. Must be a California Resident for tuition purposes[CS1] .

3. Must be an enrolled member in a federally recognized Native American, American Indian, and/or Alaska Native tribe.

Students must submit tribal enrollment documentation from their federally recognized tribe and/or from the Bureau of Indian Affairs (BIA). Documentation may include one or more of the following:

- Certification of tribal enrollment on tribal letterhead

- Enrollment/membership card that contains the tribal seal and/or official signature of a tribal leader

- Certification of Degree of Indian Blood (CDIB) if the CDIB includes tribal enrollment information

- Tribal identification card with an enrollment number

In addition, students must submit tribal contact information (address, phone, and email) if it is not evident on the submitted documentation[CS2] [HH3] .

All information must be submitted via email to UCLA Fellowships (uclafellowship@grad.ucla.edu) with the subject line: NAOP.

How to Apply:

Students entering the UCLA School of Nursing are advised to submit the Free Application for Federal Student Aid (FAFSA) or California Dream Act Application (CADAA). The priority deadline is March 2. The UCLA school code is 001315.

Learn more about applying for aid

Corbett Disclosure Statement

Students considering student loans need to be aware of the differences between federal student loans and private student loans.

SB 1289 Disclosure Statement

Important Notice: Federal student loans are available to most students regardless of income and provide a range of repayment options including income-based repayment plans and loan forgiveness benefits, which other education loans are not required to provide.

- Federal student loans are required by law to provide a range of flexible repayment options including, but not limited to, income-based and income-contingent repayment plans, as well as loan forgiveness benefits that private lenders are not required to provide.

- Federal direct loans are available to most students regardless of income. Other qualification criteria do apply.

- Private student loan lenders can offer variable interest rates that can increase or decrease over time, depending on market conditions.

- The interest rate on a private loan may depend on borrower's and/or cosigner's credit rating.

- Private student loans have a range of interest rates and fees and students should determine the interest rate of, and any fees associated with, the private student loan included in their financial aid award package before accepting the loan.

- Students should contact the lender of the private student loan or their UC campus' financial aid office if they have any questions about a private student loan.